[I co-wrote a whitepaper with Natalie Smolenski on CBDCs which is available to read here. Below is my undiluted, short-from original before we worked on it together]

Overview of CBDCs

CBDC stands for “Central Bank Digital Currency”, a digital fiat currency issued, controlled, and run by a central bank.

In other words, CBDCs are not just digital representations of fiat currencies, like the money held in online bank accounts. Because the money is issued by Central Banks, CBDCs enable consumers to have direct relationships with Central Banks, rather than relying on commercial banks to serve as intermediaries between the two.

Proponents of CBDCs emphasize their benefits: now cash transactions can take place digitally, instantly, and at a very low cost. Intermediaries who currently steward cash transactions, particularly across borders are removed, dramatically lowering friction and costs for consumers. However, the same benefits are already available with cryptocurrencies not issued by governments for example, with Bitcoin, a stateless currency whose value floats freely in a 24-hour market, or stablecoins, whose value is pegged to that of a fiat currency.

How to impose a CBDC

“We’re doing it for compliance”

CBDCs enable Central Banks to have direct insight into the identities of transacting parties and can block, confiscate, or censor any transaction. Indeed, government demands to have visibility into every financial transaction conducted with state-issued currencies is a chief driver behind the quiet push to eliminate physical cash in countries around the world.

Elimination of Physical Cash

In order to enact CBDCs, they will need to ban physical cash. This enables them to have complete control over the economy. Also, they can disincentivize holding digital cash by imposing “penalty” (negative) interest rates on balances over a certain amount. After all, if too many people rush to demand cash (hard money) at once, commercial banks will be deprived of funding and may dramatically reduce their lending if they can’t find other sources of capital.

Structural Problems with CBDCs

Scope Creep

CBDCs would inherently cannibalize the commercial financial system. If consumers placed all their funds in an account with the central bank, then it would hurt commercial banks’ ability to attract depositors and perform their natural function of offering loans/mortgages and other banking activities.

JPMorgan strategist Josh Younger estimates that 30% of commercial banks’ funding base could leave from checking accounts to CBDC accounts.

He recommends keeping a low cap limit on CBDC accounts, approximately $2,500, in order to minimize the impact of this transition (Like the Bahamas have done). Most households have less than $1,000 in their checking account, so that would meet the needs of most lower-income households. Any cap on account limits could easily be raised or outright eliminated by a future Congress.

But make no mistake, our government would nationalize the banking industry with the creation of a CBDC.

Governments are poor at execution

Whether it be social welfare programs, military conflicts, or regulations, governments have time and time again proven to be poor allocators of capital as they have no incentive to do it efficiently. A CBDC would be no different.

In a eye opening thread posted by “@arbedout” he details the journey of USPS’ 1980’s service “E-COM (Electronic Computer Original Mail)” which reads as an absurd tale of the USPS’ journey to develop their version of electronic mail.

The USPS wanted to expand the scope of the physical postal service to the digital world. Between 1969 and 1976, 21+ studies were produced exploring various ways to enabling the Post Office to handle electronic mail.

The Postmaster General "described the adoption of electronic transmission of mail as the 'obvious next step for the Postal Service.”

"For over a century, the monopoly over letters had provided a stable foundation upon which postal service rested, but now, new information and communication technologies made the monopoly porous."

This sounds eerily similar to CBDCs.

Despite understanding that e-mail represented a threat to the USPS, and even though they had all the resources and stakeholder alignment, they fundamentally misunderstood their customer.

No one wanted to use the product. They literally printed out the e-mails and then mailed them locally. Who would want to send e-mails to the Post Office then have them print the e-mails out and send them via regular physical mail!?

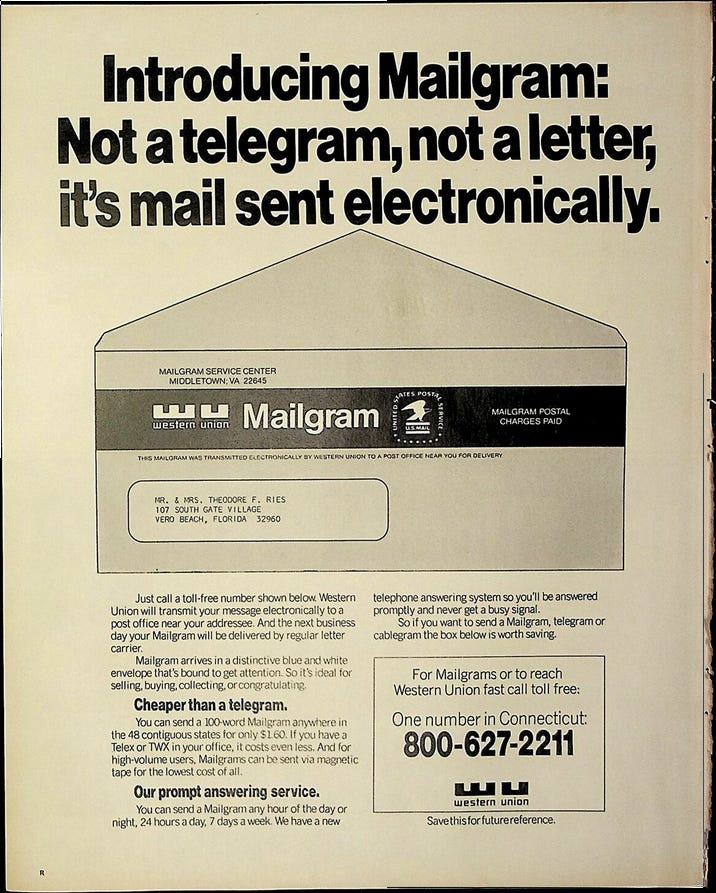

E-COM was actually the second try at “mail sent electronically.” Over a decade earlier, in 1972, they had partnered with Western Union vai “Mailgram” a similar service which would enable users to send messages via Telex to be printed and send via physical mail.

Privacy

In a recent CBDC hearing, Rep. Tom Emmer (R-MI) highlighted the huge privacy issues with a CBDC:

"Any attempt to craft a central bank digital currency that enables the Fed to provide retail bank accounts and mobilizes the CBDC rails into a surveillance tool, able to collect all sorts of information on Americans, would do nothing but put the United States on par with China's digital authoritarianism."

Centralized Risk

There have been egregious breaches of sensitive information held by the government including spy secrets/exploits (in which the US government allowed business and citizens open to exploit by them and other governments), military secrets, and financial infrastructure.

Can we trust The Fed to perfectly protect our most sensitive information? That there will never be a breach? Because if there was a breach, we’re talking about every single transaction of yours permanently displayed for the world to see.

Authoritarian Control

When certain politicians complain that “we’re behind China” in implementing a CBDC, it’s quite a weird statement. It’s akin to saying “we’re behind China with building concentration camps.”

CBDCs are inherently authoritarian, which is probably why China is pursuing them. Thus, a strong argument could be made that a CBDC will actually slow down China's desire to be a global reserve currency. What country would want to use it, when they could instead hold dollars that aren't spying on it?

Finally, here’s what a CBDC could do:

Tax individual transactions based on income level, race, or religion

Force citizens to spend money on specific items or under a certain duration

Censor transactions due to statements on social media (social credit score)

Alternatives to CBDCs

Fiat currencies are already highly digital

Digital dollars and other fiat currencies are created and used today through the commercial banking system. People deposit their fiat-denominated holdings at a commercial bank (ex: Bank of America) and then transact electronically using a variety of digital payment rails like ACH, Fedwire, and Swift. Commercial banks, in turn, use digital record-keeping to track their ledger balances with Central Banks.

Stablecoins

Some also worry about how Stablecoins might threaten the US Dollar and/or compete with a CBDC. Historically, the Fed has supported innovation in the private sector, and as part of that Stablecoins could extend the use of the dollar by making transactions cheaper across borders and between businesses.

Worries about stablecoins destabilizing the US economy are misplaced. As Quarles again said eloquently:

“the concern that stablecoins represent the unprecedented creation of private money and thus challenge our monetary sovereignty is puzzling, given that our existing system involves—indeed depends on—private firms creating money every day.”

There are certainly risks to stablecoins being partially backed, and structurally unsound, but there are various ways that can be remedied through audits and other transparency measures.

Bitcoin

The highly surveilled and controlled world of digital money suggests that a meaningful alternative must be private, uncensorable, and free. These are characteristics of bitcoin: a global cryptocurrency issued by a protocol rather than by a bank. Bitcoin was launched to preserve a space for individual economic freedom in a world where economic life increasingly takes place on the world wide web–and where surveillance and censorship are easy to implement. Bitcoin provides all of the purported benefits of CBDCs for end users (instant, low-cost or even free transactions, domestically and across borders; final settlement) but without built-in surveillance and transaction control, and without the ability to control Bitcoin’s monetary policy. For these reasons, it presents an important alternative to both CBDCs and digital dollars.

Conclusion

As Quarles eloquently stated, utility in the US Dollar doesn’t come from technology, it comes from the trustworthiness of our government, economy, and monetary policy.

Stablecoins are an extension of that trust utilizing a new innovative technology: the blockchain. Stablecoins hold great promise to further the demand for US Dollars, promote innovation at the corporate and individual level, and allow the free market to work as intended.

Ultimately, I believe Bitcoin is the money that most resembles the attributes that CBDCs strive for with efficiency, trust, and privacy.

As US citizens, what do we want? Do we want to be like China and allow our government to have complete control over every action? Over every payment? Over every aspect of our lives? All for the dubious claim of innovation or efficiency?

Or do we want to embrace the core cultural values of America: freedom, risk-taking, property rights, and equality?

To CBDC or not CBDC, that is the question.

If we assume these are rolled out, do you think there is a secondary 'blackmarket' of offshore assets, that enable private economic life to continue or do you think this is all consuming?

Good points especially the replacement of paper or plastic anonymous cash . That will help programmable money from governments with ever increasing deficits get enormous control over our lives !!