Stacks gets a big upgrade: Nakamoto and sBTC

Nakamoto improves speed and reliability, while sBTC finally bridges Bitcoin into Stacks in a more secure manner

Disclosure: I am an advisor at Trust Machines which is run by Muneeb the founder of Stacks. Trust Machines builds on all Bitcoin layers.

Unleashing the Bitcoin Renaissance

Bitcoin DeFi has exploded onto the crypto scene over the last year. While it’s something I’ve been writing about for the last 3 years, it took the 2023 Ordinal boom + a flood of capital into L2s earlier this year to wake everyone up to what is the biggest opportunity in crypto.

People forget that Bitcoin isn’t just the largest crypto asset in the space, it’s bigger than everything else combined. When DeFi on Bitcoin is unlocked, it will unleash a wave of innovation, interest, and ultimately utility for Bitcoiners. The chart below highlights that opportunity.

This is also why I joined Asymmetric to be the Co-GP of the Bitcoin DeFi Venture Fund to invest in the category and support Bitcoin builders. While Asymmetric only invests in primarily early stage deals, we are excited to see the larger and more mature L2s lead the Bitcoin DeFi charge. One of those is Stacks.

You might have heard about their recent Nakamoto Upgrade and upcoming sBTC launch. In this newsletter I’m going to explain why both are so important to both Stacks, and Bitcoin.

Nakamoto Upgrade: What is it and why is it important?

Nakamoto is a recent hard fork on the Stacks network designed to bring many benefits.

The Stacks network used to have the following issues:

Slow blocks: Historically, because Stacks blocks have been anchored 1:1 to Bitcoin blocks, slow block times and transaction times have been one of the biggest pain points for Stacks users and developers.

Forking: Stacks forks are not tied to Bitcoin forks, allowing cheap reorgs. Also Stacks forks happened due to poorly-connected miners

MEV: Bitcoin MEV allowed Bitcoin miners to disrupt the Stacks mining process

What Nakamoto fixes:

Fast blocks: The time taken for a user-submitted transaction to be confirmed will now take on the order of seconds, instead of tens of minutes.

Bitcoin finality: Stacks is now secured by 100% of Bitcoin hashpower. Once a transaction is confirmed, reversing it is at least as hard as reversing a Bitcoin transaction. The Stacks blockchain no longer forks on its own.

MEV Resistance: This proposal alters the sortition algorithm to ensure that Bitcoin miners do not have an advantage as Stacks miners. They must spend competitive amounts of Bitcoin currency to have a chance of earning STX.

(A more detailed and technical description of the Nakamoto Upgrade is available to read here)

This alignment with Bitcoin's security model further establishes Stacks as the leader among secure, scalable Bitcoin L2s. This is a big part of the promise of building on Bitcoin, the world’s most robust, battle-tested blockchain.

Note that even Satoshi was interested in merged mining ideas (ex: Namecoin) and contributed to how it might work. Rootstock carried that idea forward a bit, and now with Stacks Nakamoto you get an improved iteration of the idea: 100% Bitcoin hash power securing transaction ordering and block record or L2/Sideechain with no consent from Bitcoin miners and always at 100% hashpower capacity. Previous iterations of merge mining run a rates lower than 100%. .

sBTC: a more secure Bitcoin bridge

In the next couple weeks, Stacks will release sBTC, a non-custodial 1:1 Bitcoin-backed asset that operates as an open-network, decentralized 2-way peg solution to bring Bitcoin into Stacks with as little counterparty risk as possible. This has been a vision for years, and you’ve probably heard something about it over the past few months. As a refresher, here’s what to expect from this long-awaited bridged Bitcoin:

sBTC unlocks Bitcoin’s full potential as a programmable, productive asset for decentralized applications

With sBTC, building on Bitcoin is faster, cheaper, and easier – without compromising security and user experience

sBTC features an elite Signer network featuring industry leaders like Bitgo (securing $10B in WBTC), Blockdaemon, Kiln, Luganodes, Copper, Figment, and many more.

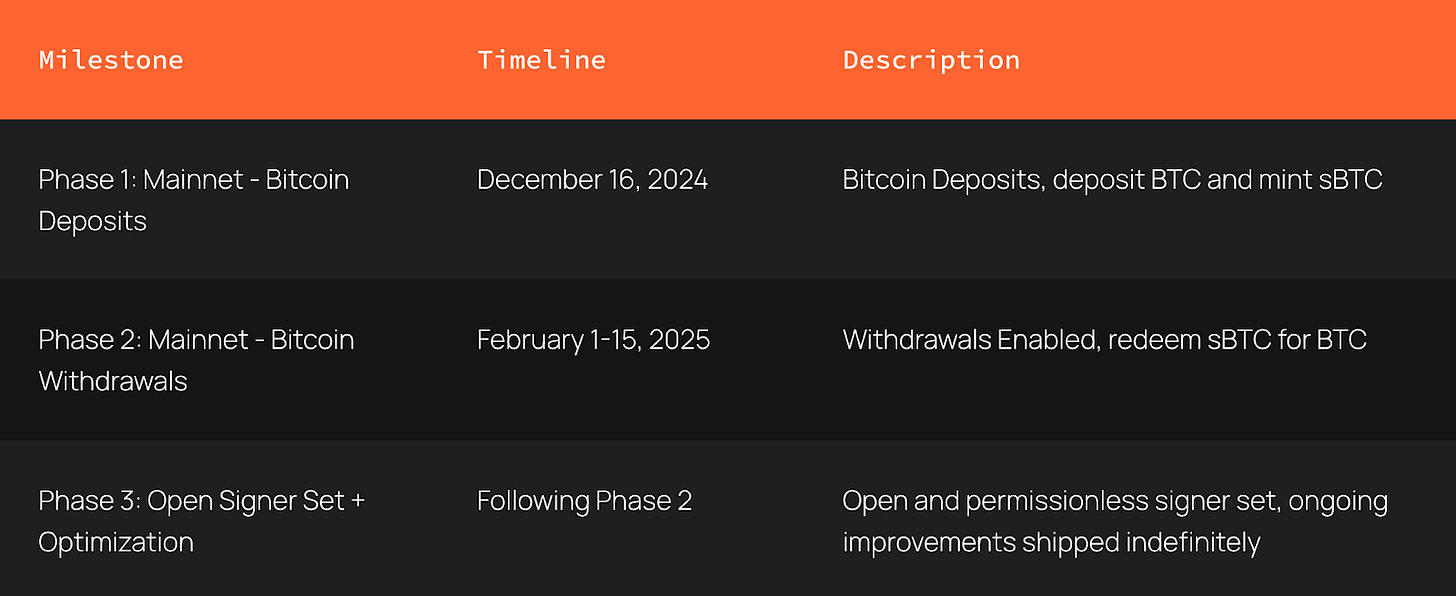

Here are the timelines and milestones that are coming up soon:

To launch sBTC, an allocation cap of 1,000 - 3,000 Bitcoin will be reserved for early supporters who will earn ~5% APY paid in sBTC. Of course you can then take your sBTC and deploy it into various DeFi applications to earn additional yield (note that all yield comes with risk!).

On December 16th, 2024 sBTC will go live. Users will be able to deposit Bitcoin via sBTC.tech. However, it’s first come first serve, interest can be submitted here.

You might ask, so where does this yield come from? It’s primarily incentive yield from Stackers who want to subsidize/incentivize the early bootstrapping of sBTC.

Conclusion

As Bitcoin DeFi continues to grow, it becomes harder for crypto folks and Bitcoin puritans to ignore. Big upgrades to popular Bitcoin L2s like Stacks help Bitcoin builders to create Bitcoin DeFi applications that push the sector forward.

HODL,

Dan Held

I think another unique feature of Stacks is that it is the only L2 smart contract solution that supports bitcoin miners continuously via transaction fees and proof of transfer. The other solutions bridge out btc to their ecosystems and it may take years for that to come back to bitcoin and support its economy (wBTC, cbBTC, etc). These other solutions accrue no value to bitcoin and are only interested in leeching btc liquidity. Also, their solutions will and are currently being replicated on Stacks. If I need correcting in my understanding, please feel free to do so.

Do I need to move my STX off Coinbase to take advantage of new/upgraded tokens from the hard fork?