Revisiting The Bitcoin Supercycle

Background

Most readers will remember my popular article “A Bitcoin Supercycle” that I wrote in December 2020.

For those who don’t know what a Supercycle is: essentially this Bitcoin cycle will be different than the ones previously.

My critics said that coming up with a super-bullish thesis in the middle of the bull run was easy. But I didn’t come up with it during the bull run, I came up with it during the bear.

The Bitcoin Supercycle was first mentioned in October 2019 (Bitcoin was around $8,500), where I highlighted how this bull run might be different.

Folks often ask me “Dan what are the signs that we’re in a supercycle?”

Below I’ll revisit my original theories and see how well we’re tracking along!

Money printer go Brrrr

Bitcoin was planted during the 2008 financial crisis as an antidote to bad central banking policy, but it has grown during a macro bull run (largely no recessions or depressions from 2008 - 2020).

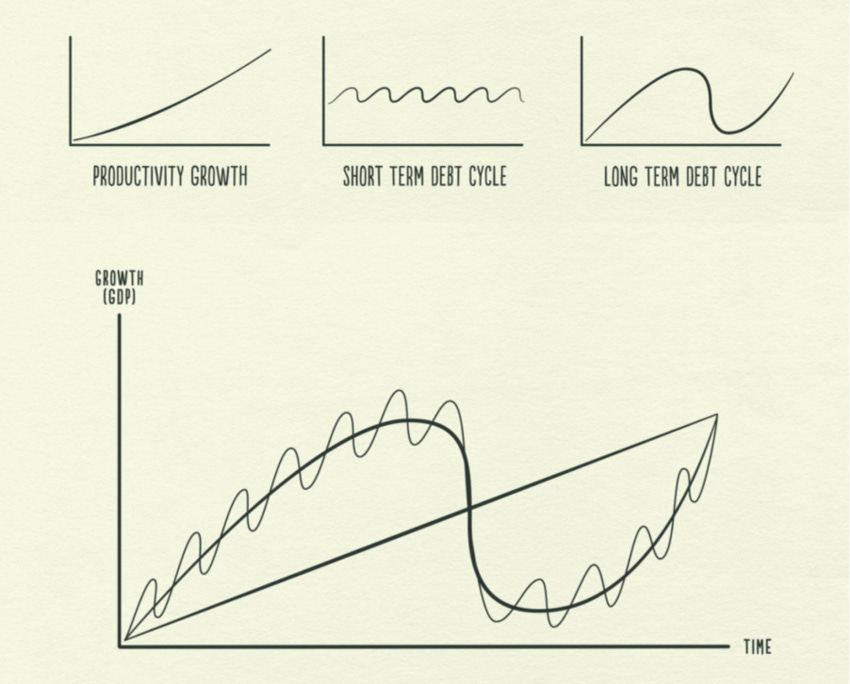

Every 7-10 years we typically experience a short-term debt cycle boom-bust in the macro markets.

Bitcoin goes through ~4-year “microcycles” that are aligned with halvings.

You probably first heard of Bitcoin in 2013 or 2017 when friends and family were talking about the wild swings in price.

Some hypothesize the 4-year cycles are induced by halvings (a reduction in new supply). The idea being a reduction in supply + increase in demand = number go up. We can call this Bitcoin’s viral marketing loop. Satoshi describes it succinctly:

“As the number of users grows, the value per coin increases. It has the potential for a positive feedback loop; as users increase, the value goes up, which could attract more users to take advantage of the increasing value.” - Satoshi Nakamoto

Note that Satoshi wrote this before Bitcoin was even worth $0.01. In the chart below, we have Bitcoin’s price, and halvings which are the dotted lines. As we can see, a bull run has occurred after each halving.

With Bitcoin’s current 4-year microcycles coinciding with the longer macro ~10-year cycles, that puts Bitcoin in a potential Supercycle.

This is similar to Ray Dalio’s observation of short and long-term debt cycles but on an accelerated timeline.

When COVID came, the markets plunged. Bitcoin eventually recovered while governments across the world engaged in unprecedented money printing (aka stimulus). And when I say unprecedented, I mean never before in all recorded financial history. $25+ Trillion was printed across the world to bolster the traditional finance system. This meant that governments were actively devaluing their currency, which is exactly what Bitcoin was built to protect against.

Bitcoin was special purpose-built to be a store of value in a world where you can’t trust your government or bank. Those moments don’t come around often though, like the 2008 financial crisis.

And governments haven’t stopped printing money. As of a few weeks ago, leaders in the United States government started on their 4th round of stimulus.

There’s no stopping the money printing machine. This is a strong indication that this microcycle could be a Supercycle.

COVID/macrocycle brought Bitcoin’s value into focus for the world. And because of that, a new market participant started to buy Bitcoin: the institutions.

Institutions are here

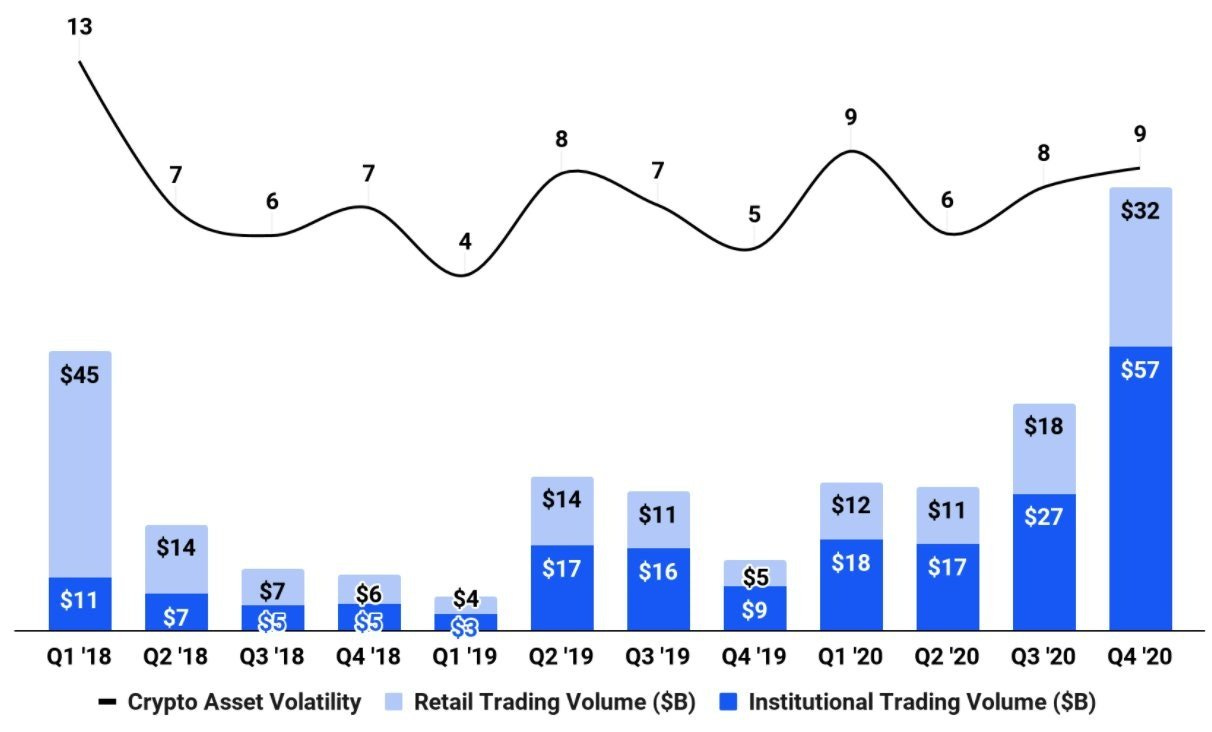

The last time I wrote about the Supercycle, hedge funds and investment banks had just started to buy Bitcoin in Q4 2020. We saw this reflected in Coinbase’s Q4 2020 financials as institutional trading volume started to represent a larger portion of their overall volume.

The tide has completely shifted on the institutional front. Now all of the hedge funds, investment banks, and FinTechs are piling into Bitcoin.

This hilarious collage shows the transition of institutions from skeptics to advocates.

Since the end of last year, we saw the institutional narrative snowball into corporate buyers of Bitcoin, including Tesla’s announcement that they purchased $1.5B of Bitcoin to put on their balance sheet in February. This was a huge checkmark for the Supercycle theory. I honestly didn’t think this would happen for another microcycle.

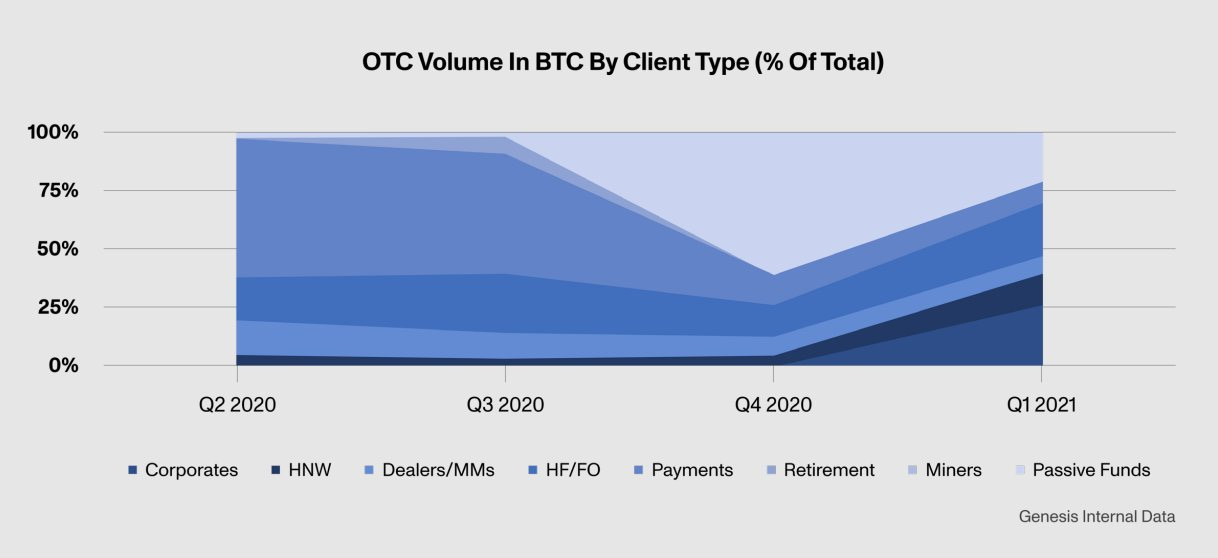

While it takes some time for other corporates to disclose their Bitcoin positions, in @GenesisTrading's recent Quarterly Report they "saw volume from 'Corporates' increase to over 25% of our total activity. Much of this surge was attributable to a mix of clients taking positions in bitcoin for the first time..."

We should see some of these reflected in future earnings announcements over the next few months.

So why are institutions important?

Without institutions, Bitcoin would be relegated to being a niche asset adopted and held by individuals who have little to no influence over global finance/politics.

This is an important transition in Bitcoin’s adoption curve. As it becomes more widely recognized as a store of value, it becomes further ingrained in our world.

Institutions coming into Bitcoin legitimizes it for retail traders, who then pile into Bitcoin.

Promoted: CryptoTag is the most secure storage system for your Bitcoin wallet backup. Fireproof, waterproof, crushproof, bulletproof, it’s the best way to store your Bitcoin.

A singular story

In the 2017 bull run, there were many competing narratives to Bitcoin’s “Gold 2.0 narrative.” Many of you probably remember ICOs.

Also, Bitcoin was fighting against another narrative which was the confederate fork Bitcoin cash which felt that Bitcoin’s purpose was to be a cheap PayPal.

Both the dapp platform and cheap PayPal narratives failed to find traction and have largely faded away.

Right now, Bitcoin’s “Gold 2.0” narrative is the primary narrative that is driving the crypto space forward. It is the largest focal point that will continue to accrue attention and purchasing demand.

Additionally, there was very little content to help newcomers understand Bitcoin, and for existing Bitcoiners to maintain the faith. After the 2017 bull run, there was an exponential wave of great content that enabled a higher conversion rate of nocoiners to Bitcoiners.

Ease of use

In the 2013 and 2017 Bitcoin bull runs, it was relatively hard to buy Bitcoin. Often you had to send a wire and understand how an order book worked.

Now you can buy Bitcoin with PayPal, or your traditional brokerage like Robinhood. Even apps like Cash app and SoFi have Bitcoin purchasing available.

After I wrote the original Supercycle article, there have been more and more services that have come out to support the purchasing of Bitcoin for both retail and institutions.

The Bitcoin supercycle

This Bitcoin cycle is different. Bitcoin was made for this moment.

Never before has Bitcoin had such strong fundamentals against a macro backdrop (traditional financial system) that highlights exactly why Bitcoin is needed, the narrative is singular, and the ability for global value to flow into Bitcoin has never been easier through the rise of institutional adoption.

What happens when ownership of Bitcoin moves from 0.01% of the world to 1%?

It certainly won’t be going to just $100k or $300k. It could blast past that or have a more mild bear market, in other words, a Supercycle.

HODL,

Dan

Thanks for update, Dan! It’s going to be a really interesting year. Hope to see you at the Miami 2021 Bitcoin conference. Keep up the great work.

This is a great companion piece to your recent interview on the 'What Bitcoin Did' podcast.