Mezo: A New Bitcoin Economic Layer

I first invested in Mezo as an angel in January, then Asymmetric invested in their latest round led by Pantera.

Below are my quick thoughts on Mezo, and why I believe in the team and their ability to build some of the key pillars of “BitcoinFi” (Bitcoin DeFi).

Why is DeFi on Bitcoin important?

Bitcoin is the largest asset in the crypto ecosystem. It’s so large that it’s larger than everything else *combined.* For good reason, it’s the best store of value asset in the world.

Bitcoin, being the best store of value in the world, makes it a pristine piece of collateral. Collateral is a core component of DeFi. Being able to borrow dollars using your Bitcoin as collateral, using Bitcoin to be staked as collateral on other Proof of Stake chains, or to secure Bitcoin L2s, etc.

What is Mezo?

Mezo is Bitcoin’s economic layer. The term “Bitcoin L2” is thrown about quite a bit, so they decided to more simplistically define who they are as an “Economic Layer”

With Mezo, the goal is to unlock more utility from your Bitcoin with various DeFi applications, such as:

Lending and Borrowing: Lend your BTC to earn interest or borrow against it to access liquidity for other investments. This includes borrowing Bitcoin-backed stablecoins, allowing you to spend fiat while saving your Bitcoin

Yield Farming: Participate in yield farming strategies to maximize your returns on BTC

Decentralized Trading: Trade on native DEXs

Derivatives: Access Bitcoin-based, on-chain derivative products

How is tBTC related to Mezo?

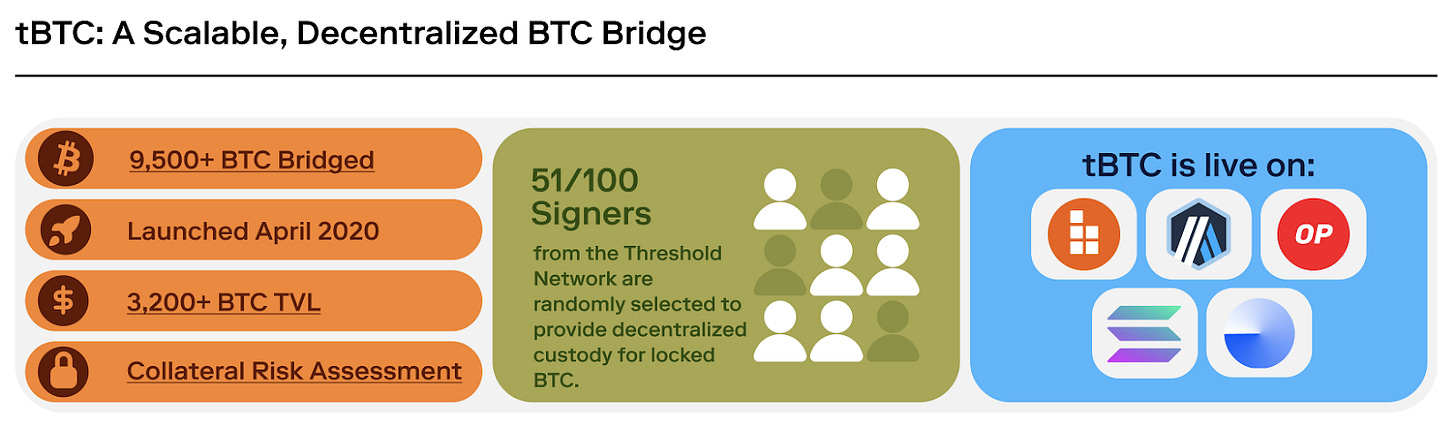

One of Thesis’ first BitcoinFi products was a decentralized Bitcoin bridge called tBTC over 5 years ago. This bridge is being used by Mezo and other Bitcoin L2s like @BOB. A bridge allows for you to take your Bitcoin from the Bitcoin base layer and bridge it or port it to another chain.

Unlike centralized solutions like wBTC, which rely on a single custodian and are susceptible to counterparty risk and regulatory concerns, tBTC employs a decentralized custody model.

This means that your Bitcoin is not held by a single entity but rather distributed among a network of stakers within the Threshold network. This approach significantly reduces the risk of theft or loss, as no single point of failure could be exploited.

Team

I’ve known Matt Luongo, the CEO of Thesis, for almost 9 years. He’s a seasoned builder who understands what it takes to execute, win, and build. And he has surrounded himself with a sharp folks. This is the right team to build a Bitcoin economic layer. Here’s their track record:

- Fold (2014): spend Bitcoin and earn rewards

- tBTC (2020): permissionless Bitcoin bridge

- Keep (2020): privacy layer for public chains

Realizing the Future of Bitcoin DeFi

BitcoinFi represents the future of Bitcoin, transforming it from a passive store of value into a dynamic, yield-generating asset. By leveraging the strengths of tBTC and Mezo, users can participate in various financial activities and products while maintaining the security and value of their BTC holdings. It brings us closer to fulfilling the vision of Bitcoin as the reserve currency for a new, decentralized financial system.

If you want to learn more, click the Mezo link below

I tried to get into Mezo's Discord group to get more info, but I'm not able to get past the (non existent) captcha. So since there is no question, there's no way for me to type in the answer. Tried both in the Discord app as well as in Safari. Please check it or let me know if there's a solution. Thanks.

This framing of “BitcoinFi” feels more like marketing than reality. While bridges like tBTC are technically interesting, the idea that they “decentralize” Bitcoin is misleading. tBTC relies on Ethereum infrastructure, which introduces a new layer of risk—smart contract bugs, economic incentive failures, and ETH price volatility. You’re not holding Bitcoin anymore; you’re holding a synthetic IOU governed by a different network entirely.

Calling this the “future of Bitcoin” ignores the fact that most Bitcoiners don’t want or trust wrapped assets, and for good reason. There’s a reason Ethereum and Solana dominate DeFi: they were built for it. Bitcoin wasn’t, and every attempt to force-fit yield-bearing functionality into Bitcoin ends up recreating the very complexity and custodial risks that Bitcoin was designed to avoid.

This isn’t unlocking Bitcoin’s potential—it’s outsourcing it. And in doing so, it undermines Bitcoin’s core value: simplicity, security, and true self-custody.