How to pay 0% taxes on your Bitcoin

[Disclaimer: I am not a tax expert, and you should consult tax experts before engaging in financial decisions. Choice is a sponsor of mine]

Background

Retirement accounts are special types of financial structures that allow for people to shelter their savings from taxes, or reduce taxable income today.

For simplicity, I’m just going to cover US retirement accounts. There are several basic types of retirement accounts in the US: 401k, IRA, and Roth IRA (several others exist but I’m skipping those for brevity).

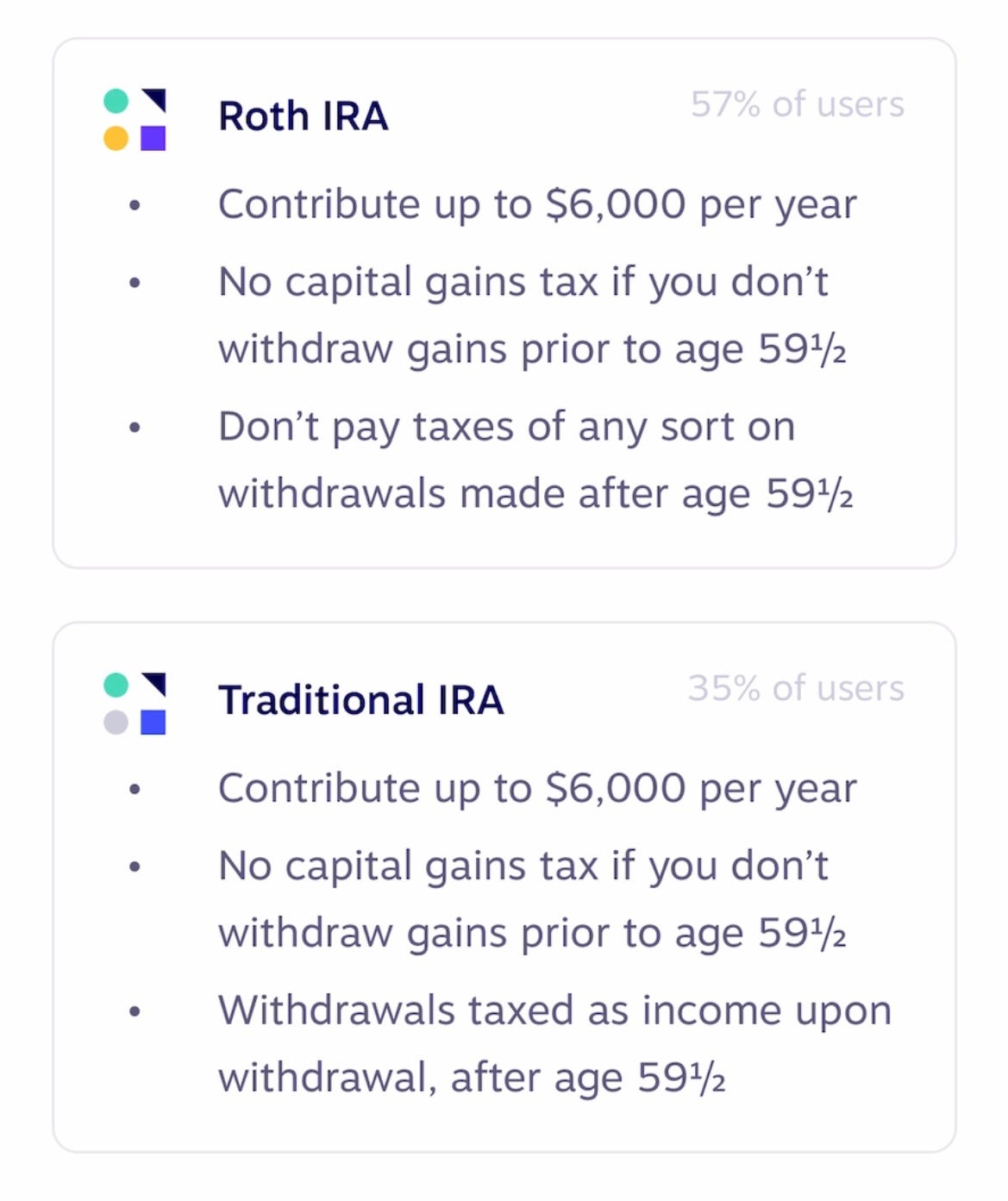

Individual Retirement Accounts (IRAs) were created in 1974 and designed to encourage US citizens to save for their future. When the government decided to treat Bitcoin as property for tax purposes in 2014, they also opened the door for it to be held in IRAs alongside other alternative assets. These are the two common types of IRAs:

Traditional IRA: A retirement account where you contribute pre-tax income, and then you pay taxes whenever you withdraw (ex: 60 years old)

Roth IRA: A retirement account where you contribute post-tax income, and all gains then are tax-free. For HODLers this is the ultimate dream of never having to pay taxes. There are certain contribution limits, and limits based on income though which I’ll go into later.

Service Providers

I went searching for a way to buy Bitcoin in my retirement account. Not GBTC or another derivative, pure Bitcoin.

I looked at a variety of options, including Bitcoin IRA, iTrustCapital, AltoIRA, and Unchained Capital. But ultimately landed on Choice for a variety of reasons:

Cost: more transparent than other services, simpler pricing

Custody options: subsidized, cold storage, and self custody (I’ll cover these later)

Process: super quick and easy to get set up

Team/Company: first qualified custodian of Bitcoin in the US

Custody Options and Cost

Choice offers 3 different ways to custody your Bitcoin:

In-motion: Cheapest option but your Bitcoin is loaned out (fees are subsidized)

Cold Storage: Stored with Fidelity. Fees are 1% annualized

Self custody: Higher setup fee + $120 annual fee, but no % based fee

Process

After choosing which account type I wanted (Self-Custody), I then went to go sign up.

It took me around 4 minutes to get an account set up via their mobile app. I selected a traditional IRA, but ideally, I would have set up a Roth IRA which means that I don’t pay taxes on any gains. Unfortunately, this option isn’t available for me given my income level (single tax filers must have a modified adjusted gross income (MAGI) of $140,000 or less). Here are some other details on the two options:

Transferring the assets takes a bit longer than that though. Around 2 weeks if you liquidate your existing retirement account assets and transfer via check. Around 4 weeks if you want to transfer assets (ex: equities or bonds). This latency isn’t unique to Choice, but is primarily due to traditional brokerages that drag their feet (they want to make it hard to leave since they are losing business). Note that you can’t contribute Bitcoin to your IRA unless you already have it in an IRA. Contributions can only be made with Dollars.

Note that you can also invest in equities, metals, real estate, and other investments with Choice. It’s not just Bitcoin if you don’t want it to be.

Team

The parent company is Kingdom Trust, the first qualified custodian to custody Bitcoin in 2017. They currently serve over 125,000 clients and have over $18 billion in assets under custody.

I’ve chatted extensively with the team and they are top-notch. Loved the service, they answered every question I had. They’re also transparent with the fees, how long things will take, and what they can and can’t do.

Oh, and it’s run by a bunch of Bitcoiners! Don’t believe me? Just check out the CEO or company Twitter profiles.

Time is of the essence

The best time to stack sats was yesterday, the next best time is today.

I regret not doing this sooner. The sooner you begin the better since gains are sheltered from taxes (I even had a tax CPA as a dad pushing me to do this for years).

They’ve hooked up my subscriber’s with a $50 bonus in Bitcoin if you use the below link. I get no compensation based on you signing up.

HODL,

Dan Held

If you’re a paid subscriber, check the top of this e-mail for the link to your voting form, and feel free to comment below in Substack (exclusive to paid subscribers)

Loved this newsletter? Subscribe now to the free tier to get:

Paid newsletter every week

Vote on the next topic

Q&A

Recommended Products

Earn yield on top of your Bitcoin gains

Ledn - One of the highest yields at 6.1% w/ best counterparty loan book risk. $25 bonus for signing up.

Hello Dan - Choice is prompting for a Verification Code on sign up. Doesn't look like your link is populating this. Can you supply one? Thanks.