Don't fear Tether

Whenever Bitcoin has a bull run, naysayers try to cope with missing the boat by rationalizing why it will fail through “Fear, Uncertainty, and Doubt” (FUD). Most of these are completely unsubstantiated, but annoyingly persist as negative narratives Bitcoin must fight against.

If you’re reading this post and expecting a 40 page research report with statistical analysis of Tether then stop here because I’m not going to deliver that. Neither would you have been convinced if I did.

"The amount of energy needed to refute bullshit is an order of magnitude larger than to produce it.” - Brandolini's law

I will, however, be providing simple to understand definitions and reasoning as to why Tether FUD is overblown.

I want to note that I feel weird defending Tether and Bitfinex. I don’t particularly like either company, as they’ve done a ton of shady things over the years. I am not vouching for the long term durability of either company.

Purpose of Tether

Tether is a USD stablecoin purported to be backed by fiat and other types of deposits.

It replaces the USD component for many offshore exchanges. Tether is used vs USD because it enabled these exchanges to get up and running without the need to deal with cumbersome regulations.

Traders like Tether because it replicates USD without the typical slow settlement times of the legacy banking system. Tether is especially popular in Asia and other geos where they want exposure to USD.

Trading firms like Tether as a super fast way to complete the fiat leg of arbitrage and market making opportunities. They can also participate in the creation/redemption process of Tether.

If Tether breaks its peg, and is fully collateralized, then these firms and/or Tether can make a profit by buying Tether at a discount and redeeming at par.

The basics of how crypto markets work

There are spot (buying the actual asset) exchanges like Coinbase, Kraken, and Binance. They have a variety of ways for Traders to fund their account. Traders can either use fiat (USD/GBP/etc), crypto native assets (BTC/ETH) or stablecoins (Tether, USDC).

There are other types of financial instruments called “derivatives” like futures and options that some exchanges have.

When you place a trade you do that through an order that is posted to an “order book” which is the publicly transparent ledger of all available buyers and sellers of a given trading pair (ex: USD <> BTC).

When a buy and a sell order have been paired (aka crossed) that is considered an executed order, and would register as volume.

The crypto markets consist of 10-100 million traders buying and selling all types of crypto assets 24/7 (crypto markets don’t ever close for the night, holidays, or weekends).

What is particularly unique about crypto is that price discovery occurs on multiple exchanges simultaneously. Price discovery is the process of buyers and sellers coming together to agree upon price in which an asset changes hands (a sale). I bring this up because it shows that Bitcoin’s price isn’t found in a centralized manner. Historically there have been spreads that occur due to lack of fiat infrastructure (2013 Mt.Gox vs Bitstamp premium), or local regulatory limits to capital flow (ex: Korean “kimchi” premium during the 2017 crypto bubble or Coinbase, formerly GDAX, in the US) which highlights how this price discovery process is done in a decentralized manner (but very much interconnected).

What this means is that no one exchange can “control” the price of Bitcoin. Buyers and sellers are willingly coming together at dozens of exchanges globally to decide what they perceive is the fair price of Bitcoin in that moment. Bitcoin’s price is being discovered in real world fiat like Euro, Yen, Dollars, and pounds sterling.

The claims

Tether represents an unhealthy portion of BTC volume

Many people read the article “The Bit Short: Inside Crypto’s Doomsday Machine” a few days ago which included metrics that were flat out wrong:

The author of the article didn’t know the difference between spot and derivative exchange volume. They used coinlib, which conflates derivative volume with spot inflows. Tether represents a much smaller portion of spot exchange volume.

Offshore exchanges are notorious for faking volume, in particular against Tether, so they appear liquid (which supposedly attracts traders). Bitwise has a sophisticated method to calculate real volume which can be viewed here.

For Tether issuance, the author used Coinmarketcap which also has incorrect data.

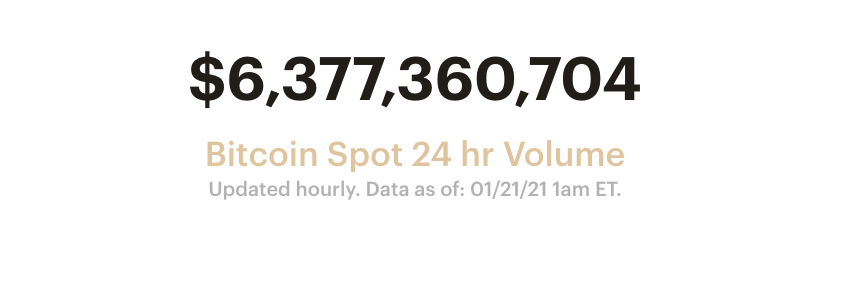

While Tether represents a common trading pair, Bitcoin has plenty of fiat non Tether volume.

Lastly, Tether’s market cap is $24B and Bitcoin is $641B at the time of this post. That is only 4% of Bitcoin’s market cap. What happened to Bitcoin when XRP, Bitconnect, EOS, ETH, and dozens of other cryptocurrencies rose and fell? Bitcoin was fine.

Tether is fractional reserve/not audited

Fractional reserve

There is some legitimacy to this claim. We do know that Tether was partially backed for a period of time (April 2019) when Bitfinex borrowed $850,000,000 to cover a hole due to fraud by one of their payment processors.

However, this had little impact on the price of Bitcoin. In the center of the white circle below we see when the market priced that information in. Max price drop was 20%, but the day closed with only a 10% drop. A relatively “normal” day for Bitcoin.

The article “The Bit Short: Inside Crypto’s Doomsday Machine” made other dubious claims that the aggregate USD claimed to be held in Bahamas bank is greater than all of the USD in the Bahamas. But not all the USD is held in the Bahamas, it’s held at correspondent banks.

Other detractors ask for proof that wires are being made in and out of Tether’s banking partners. Here’s the proof:

The CEO of FTX, Sam, one of the largest exchanges in the space has wired money to Tether and redeemed Tether for US dollars.

Dan, the former head of Circle OTC (the largest trading desk in 2017), has wired money to Tether.

The CTO and GC of Bitfinex came on What Bitcoin Did podcast to answer a wide variety of questions and provided explanations for banking relationships.

So we know that Tether is at least partially backed and has functioning wires in and out of the bank they use, Deltec.

It’s funny that folks worry about Tether being fractional reserve without first being introspective with their existing banking infrastructure. All of traditional fiat is fractional reserve. And how about altcoins? They are traded against Bitcoin and are literally printed from thin air with supply limits raised frequently.

If Tether was found to be worthless tomorrow, guess what would immediately happen to the price of Bitcoin? It would skyrocket as Tether holders convert $24B of Tether into Bitcoin.

Also, say if regulators put pressure on Tether’s banking relationships, it would likely continue to trade just as Mt.Gox coins did in a secondary market.

Audit

Many rightfully ask that Tether should produce regular audits. However, this is harder than it sounds. The problem is that no reputable (aka big 4) accounting firm would take them on as a client. So it’s a chicken and egg problem of not being audited, but no one is willing to audit them. And those accounting firms that would be open to auditing them, the FUD folks wouldn’t trust the audit.

Tether is used to pump Bitcoin

This is the most common concern. That the Bitcoin bull market was one of “vapor” due to Tether. Of course Bitcoin couldn’t have such a tremendous surge on its own right? It’s just too unfathomable that Bitcoin is changing the world/winning.

This isn’t the first time that people questioned a Bitcoin bull run and claimed that manipulation caused demand.

2013 Bull market

In 2014 there was “Willybot” a trading bot on Mt.Gox which folks claimed to have pumped the price of Bitcoin on Mt.Gox in the 2014 bull run. While it was discovered that Mark Karpeles had been running the bot to trade against his customers, it’s dubious that a single bot could have manipulated the entire global market sentiment on the value of Bitcoin.

2017 Bull market

This is the first FUD appearance for Tether, primarily from an account called “Bitfinexd” who had sold all of his Bitcoin before the bull run and had grown resentful after Bitcoin’s rise.

Another supposed bot was “Spoofy” in August 2017, which used order spoofing to manipulate the markets. Claiming that perceived spoofing caused the markets to go up demonstrated an amateur level understanding of how order books work. Orders are placed and cancelled all the time, the author was just observing normal market activity.

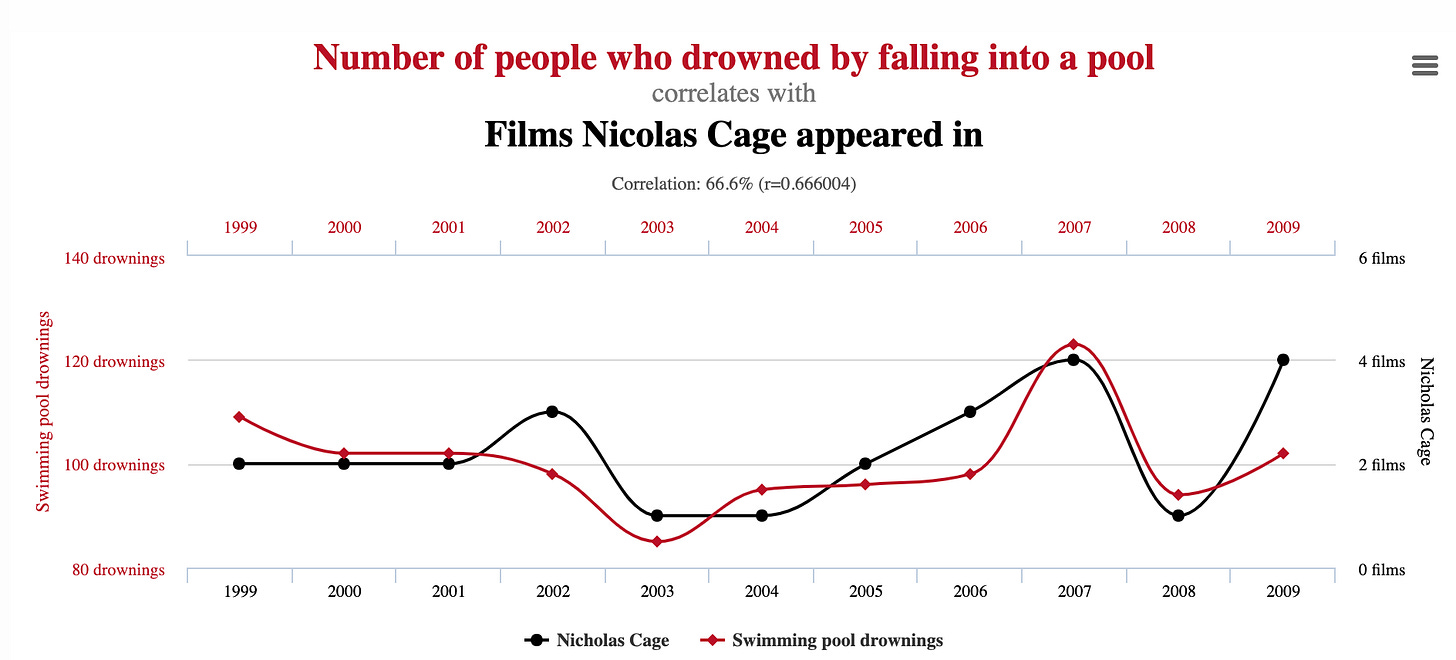

Additionally, there was a research paper “Is Bitcoin Really Un-Tethered?” that came out in 2018 by two University of Texas so called “academics”, John Griffin and Amin Shams who investigated whether Tether is used to manipulate the price of Bitcoin.

The paper demonstrated a lack of understanding of financial markets, and violated a core principle of research: correlation does not equal causation. For example, umbrellas don’t cause rain. You know what else is correlated? The number of people who drowned by falling into a pool and the number of films Nicolas Cage appeared in.

For a more in depth debunking of their report, read this deeper analysis.

Oh guess what else is correlated? USDC and Bitcoin! Where are all the concerned “researchers?!”

There’s not a single shred of evidence that $20B of tether has any relationship to the rise of Bitcoin.

And if Tether supposedly caused the 2017 pump, then why did they decide to stop in 2018, and later selectively pump in 2019 and 2020? Of course the FUDsters have no answer for this.

A side note: Tether/Bitfinex are under investigation for fraud from borrowing to plug the $850M hole, not for pumping Bitcoin.

What Tether collapse actually destroys: DeFi

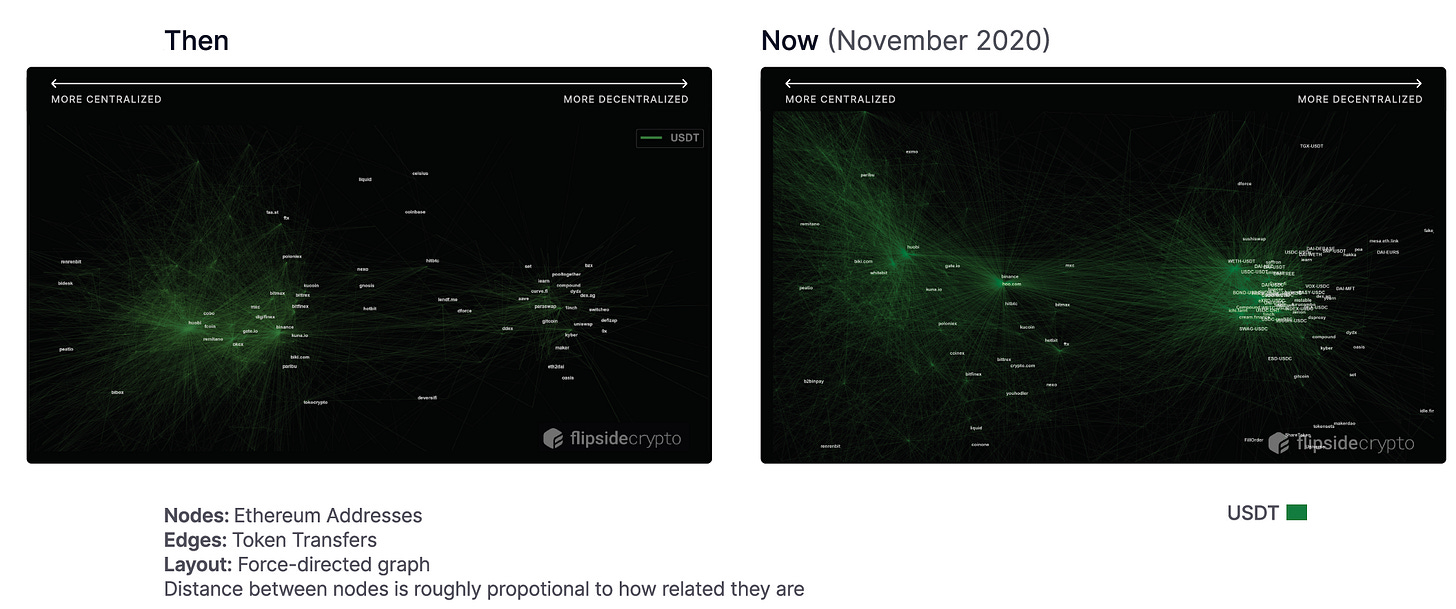

The DeFi ecosystem, primarily being on Ethereum, relies on collateral to make it all work. That collateral can be crypto native assets like ETH/ERC-20 tokens, other wrapped cryptocurrencies (BTC), fiat stablecoins (Tether/USDC), or algorithmic stablecoins (DAI).

Both Tether and USDC are centrally controlled since they are issued by companies that hold the fiat to back the stablecoin. Here’s an example of how that control was demonstrated where $100k of USDC was frozen this summer. Having smart contracts rely on these centrally controlled stablecoins makes DeFi a house of cards since at any moment the collateral posted for a contract could be frozen which would then lead to a cascading effect with other contracts that depended on that collateral. Tether becoming worthless would cause a massive structural earthquake to the Ethereum ecosystem. As we can see with the analysis done by the research firm Flipsidecrypto, Tether (green) is becoming more and more intertwined within DeFi protocols (clusters on the right).

As of October 2020, these centralized stablecoins represented $1.7B of the locked up DeFi collateral used for these smart contracts, which would have represented around 17% of all DeFi collateral (DeFi Pulse shows ~$10B locked up in collateral at that time)

If a double digit percentage of DeFi collateral gets destroyed in this intermingled system of liquidity, lending, borrowing etc, then we would see massive price dip with Ethereum and ERC-20 tokens.

Bitcoin has survived much worse

“The only thing we have to fear is fear itself” - Franklin D. Roosevelt

In it’s relatively short 12 year existence, Bitcoin has survived much more traumatic incidents:

Silk road getting shut down

Mt.Gox hacked multiple times and shut down

Other exchange hacks (Bitfinex, Bitstamp, Binance). 12 occurred in 2019 alone.

At least 43 exchange shutdowns (Cryptsy, Quadriga, etc)

Bitcoin civil war (Bitcoin vs Bcash) which included one of the most wealthy and prominent Bitcoiners Roger Ver and the most powerful mining manufacturer Bitmain teaming up on the Bcash side.

Chinese ban Bitcoin FUD

Regulatory crackdowns globally

Etc….

Bitcoin has survived all of these. Tether isn’t going to kill Bitcoin. Tether isn’t going to cause a bear market. The myriad of concerns around Tether reinforces why we need a store of value like Bitcoin - no trusted 3rd parties.

Bitcoin is stronger than ever. COVID brought Bitcoin’s value into focus for the world as a store of value. And because of that, a new wave of market participants started to buy Bitcoin: the institutions. These participants are bringing part of their $100 trillion of value they manage and using Bitcoin to store value.

Bitcoin’s “Gold 2.0” narrative is the only narrative that is driving the crypto space forward. It is the singular focal point that will continue to accrue attention and purchasing demand. Additionally, after the 2017 bull run, there was an exponential wave of great content that has enabled a higher conversion rate of nocoiners to Bitcoiners.

Finally, now you can buy Bitcoin with PayPal, or your traditional brokerage like Robinhood. Even apps like Cash app and SoFi have Bitcoin purchasing available.

Bitcoin was made for this moment. Don’t be scared by a little FUD.

HODL,

Dan Held

what an incredible piece Dan! Thanks for the brilliant insights.

That fallacious FUD article and the ridiculous comments of Janet Yellen creating a fantastic 'buy the dip' opportunity this morning which I fully capitalized on. Your rebuttal article sets the record straight and will give the community the confidence to buy and HODL on. Thanks for all you do!