Crypto Taxes v2

[Disclaimer: I’m not a tax expert. Consult tax experts before engaging in financial decisions. TaxBit is a sponsor. Use the promo code “dheld” for 25% off their service]

Background

This newsletter might look familiar. I did write about taxes at the end of 2021 because you could take advantage of losses that could offset gains but you had to do it before the end of 2021!

I wanted to cover this topic one more time as you’re prepping your taxes to help explain some of the basics around taxes and crypto + provide an update regarding how staking is taxed (per the recent lawsuit filed by a couple regarding Tezos).

This newsletter will be focused only on US customers. Unfortunately, it would take an eternity to write about every geography.

How is Crypto Taxed in the US?

Virtual currency is treated as property for tax purposes. This means that cryptocurrency is taxed as a capital asset and every taxable event must be reported on an IRS 8949 cryptocurrency tax form. Now over the years, there were many other types of crypto assets + a spectrum of taxable events:

Forks: The IRS takes the position that hard forks that result in an airdrop of a new currency are akin to a dividend for tax purposes. Put simply, a hard fork occurs when a distributed ledger undergoes a protocol change resulting in a permanent diversion of the continuing historical ledger through a new airdropped token.

Airdrops: The IRS takes the position that you are taxed on the fair market value of the airdrops when you have “dominion and control” of airdropped tokens. A taxpayer has dominion and control when an exchange issues the airdropped token into the taxpayer’s account. With a self custodied wallet, that is assumed to be the case.

DeFi: Here are some of the most common types of activities:

Lending: Lending out your cryptocurrency generates interest, which can be taxable as ordinary income or capital gains depending on the DeFi platform.

Receipt of incentive tokens: Some platforms issue tokens to reward their users, which are generally taxable as ordinary income at their fair market value upon receipt.

Transfers into tokens and liquidity pools: In general, it’s safest to assume that these transactions trigger capital gains and losses. Also note that categorizing this as “interest” maybe be incorrect!

DeFi is one of the most rapidly evolving areas of the cryptocurrency industry. Again, the IRS has yet to issue any specific guidance, but it’s generally safest to assume similar rules apply to those that govern other crypto transactions. When in doubt, always consult a tax professional.

NFTs: NFTs are usually capital assets, just like digital currencies. You can either create NFTs to sell in a marketplace, or you can invest in them to buy and sell as a trader.

Investors should generally treat them as property and follow the typical rules for capital gains and losses. It is possible, however, that NFTs could be viewed as collectibles. The IRS defines collectibles as:

Any work of art,

Any rug or antique,

Any metal or gem (with exceptions),

Any stamp or coin (with exceptions),

Any alcoholic beverage, or

Any other tangible personal property that the IRS determines is a "collectible" under IRC Section 408(m).

Collectibles are subject to a 28% long-term capital gain tax rate, regardless of income levels. The IRS has yet to confirm which NFTs are subject to collectible rules. However, it’s important to note that the difference only comes into question when assets are held for over one year.

With that being said, any NFTs sold after a holding period of less than one year will be subject to short-term capital gains tax rates (which equals ordinary income tax rates), regardless of whether they’re viewed as property or collectibles.

Crypto to Crypto transaction: Every crypto-to-crypto transaction, regardless if it generates a capital gain or loss, must be reported on your tax return.

The IRS treats cryptocurrency and other digital assets as property, so if a cryptocurrency investor exchanges one crypto asset for another, it triggers a taxable event, it’s required to be reported to the IRS.

The crypto-to-crypto trade will likely result in a capital gain or loss. That capital gain or loss is equal to the difference between your cost basis—or original purchase price—in the original asset and the fair market value of the asset being acquired.

Earning Crypto: Getting paid in crypto is just like getting paid in fiat. That is considered income.

Mining: When a taxpayer successfully “mines” virtual currency, the fair market value of the virtual currency as of the date of receipt is includible in gross income. This means that successfully mining cryptocurrency creates a taxable event and the value of the mined coins must be included in the taxpayer’s gross income at the time it is received.

Selling mined cryptocurrency also creates a second taxable event. The value of the cryptocurrency at the time it is mined (the amount included as ordinary income) becomes a taxpayer’s cost basis in the capital asset. When a taxpayer sells mined crypto then the amount received will be reported as proceeds and will be offset against the taxpayer’s cost basis in the asset. If the value of the crypto is higher at the time of the sale, then the taxpayer has a capital gain. If the value is lower then the taxpayer will have a capital loss. Every sale or trade of mined crypto must be reported on an IRS 8949 cryptocurrency tax form.

Staking: There is no specific IRS guidance on the taxation of staking yet. The best we have currently is Notice 2014-21, which is the tax guidance on mining income.

The notice states that you should report crypto income at the time of receipt for rewards, and a taxable event also occurs when you sell the mined currency. The current interpretation of the notice is that staking rewards are taxable as ordinary income upon receipt.

However, this 2014 notice fails to consider the inflationary effect of newly staked tokens and the ordeal of initiating a taxable event each time there are new tokens, which could be multiple times every day.

It’s been theorized that the IRS may issue guidance stating that taxpayers should consider staking rewards to be the creation of new property. In that case, there would be no taxable event until the sale of the property. That would do away with the need to regard their dilutive and inflationary effects on the wealth of a user. For now, though, staking rewards remain taxable as ordinary income, just like earnings from mining activities.

In 2021, a couple filed a lawsuit against the IRS seeking a refund of taxes they paid for Tezos network staking rewards they earned that year.

News recently broke that the couple and the IRS settled the lawsuit, and the couple is now set to receive their claimed refund; social media was abuzz with rumors that a potential precedent had been set. However, that isn’t entirely accurate.

TL;DR - it doesn’t mean anything as the IRS hasn’t made any rules and their argument is very unlikely to win in court. Here’s a deeper dive into the topic.

Regardless of the type of asset you’re trading, these next sections are applicable:

Tracking cost basis

Tax rates

Loss harvesting

Tracking Cost Basis

Cost basis = original cost when you bought the asset. When you have multiple units of the asset, say 3 Bitcoin or 4 shares of Uber, you need to track which exact units you sold. It’s typically better to dispose of assets that have a higher cost basis because that reduces the gains you’ve realized.

Prior to their highly anticipated 2019 guidance, there was some ambiguity as to which methods were acceptable. Here is what people would previously choose from:

First in First Out (FIFO): first units in are the first ones sold

Last in First Out (LIFO): last units in are the last ones sold

Highest Cost: highest cost units are the first ones sold

Lowest Cost: lowest cost units are the first ones sold

Average Cost: total number of dollars invested divided by units

Specific Identification: tracking specific units

However, the IRS’ new guidance specifically allows for only two cost basis assignment methods which are listed below with graphics for further clarity if you hadn’t already grasped the concept.

First in First Out (FIFO)

Specific Identification

Tax Rates

The United States distinguishes between long-term and short-term capital gains.

Short-term Capital gains

If you hold a particular cryptocurrency for one year or less your transaction will constitute short-term capital gains. Short-term capital gains are added to your income and taxed at your ordinary-income tax rate.

Long-Term Capital Gains

If you held a particular cryptocurrency for more than one year then you are eligible for tax-preferred long-term capital gains. In 2018 the capital gains tax rates are either 0%, 15% or 20% for assets held for more than a year. I don’t want to bore you by going into what income levels each one of those represents, but you can check it out here.

Losses

The difference between your capital gains and losses is called your “net capital gain.” if your losses exceed your gains, you can deduct the difference on your tax return, up to $3,000 in losses per year. If you have net capital losses for the year that exceed the deductible amount then the IRS allows you to carry the excess into the next year, allowing you to deduct it on that year’s return.

(Ad) Choice IRA

Buy Bitcoin directly in your IRA with my partner Choice IRA (which is also a great way to save on taxes ;). $50 in free Bitcoin when you sign up!

Tax Loss Harvesting

If everything before this has been a bit boring, I get it. However, you’ll want to pay attention to this section.

Tax-loss harvesting is an investment strategy that maximizes after-tax returns by taking advantage of dips in cryptocurrency market prices. Imagine if you could appreciate wealth over time while in the process increase your tax refund, or at a minimum reduce what you may owe in taxes. Tax-loss harvesting does exactly that!

How it works

Let’s say you want to HODL Bitcoin long-term, but you’ve bought higher than where the price is at today.

You can sell Bitcoin to realize the loss, then immediately buy it back. You’ll have the exact same amount of Bitcoin, but now have the losses to offset gains. This is called “wash trading.” A common question is whether or not there is any risk of the wash sale rules applying to crypto. At this time, wash sale rules specifically apply only to stocks and securities, not crypto.

This technique only works for losses in the same calendar year, so the deadline for 2021 has already passed.

How am I possibly going to do my taxes?

Picking the right tax software

There are many tax software products out there. None are perfect.

It’s nearly impossible to automatically reconcile various exchange, DEX, on-chain, etc. transactions. But what these tools can do is do some of the heavy lifting, and get you closer to your goal.

After seeing all these tools, I think TaxBit is the solution that fits the bill. I love the product and the team. In fact, I met the CEO Austin Woodward at his conference booth in 2018 when he was first starting the company. They just hit unicorn ($1B+ valuation) status earlier this year! They’ve partnered with PayPal, Gemini, BlockFi, OkCoin, Coinlist, etc.

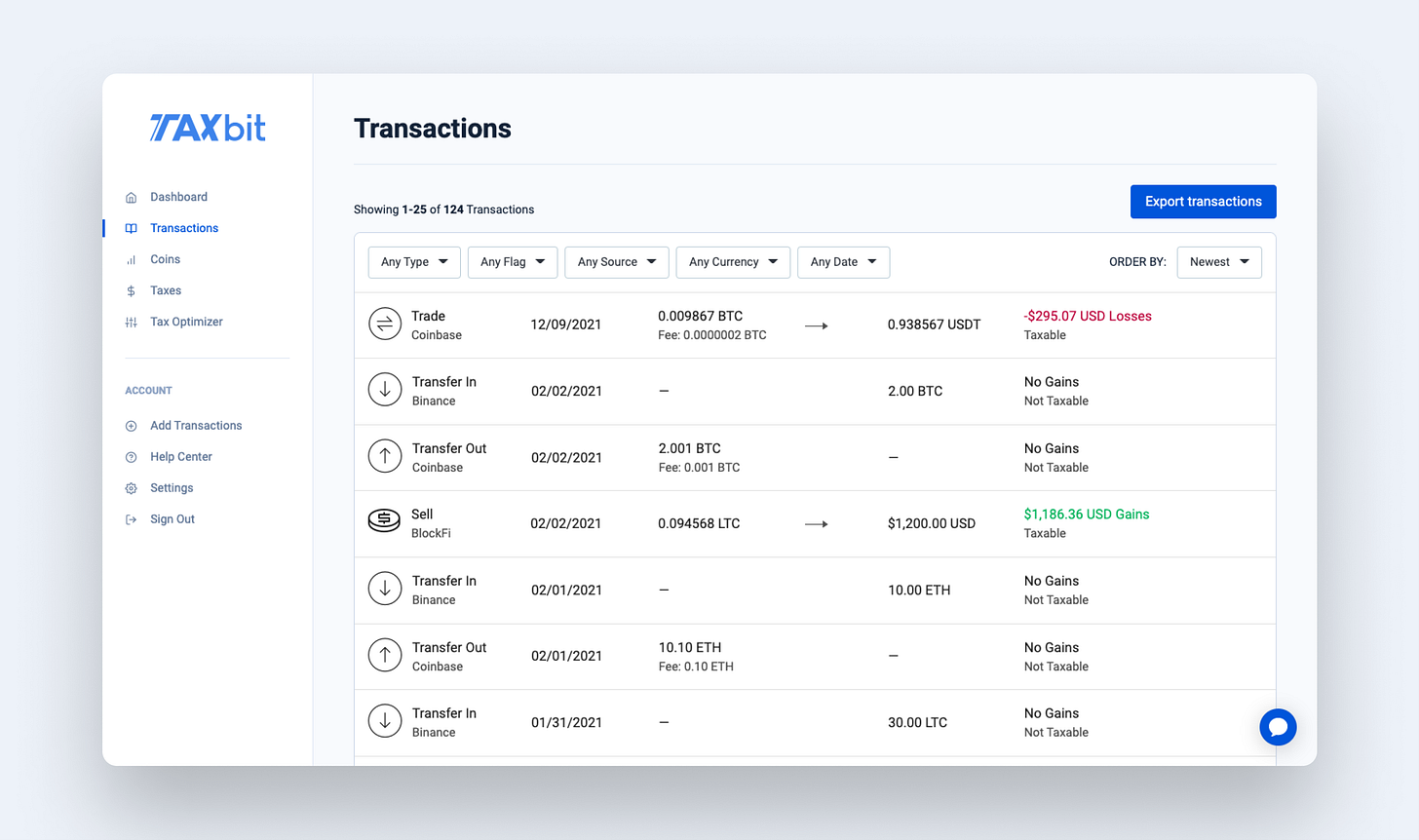

Here’s a sneak peek of their product.

In January they’ll be launching functionality to reconcile DeFi and NFT transactions! So if that’s something you’re trading in, then they should be able to cover most of your transactions.

If you haven’t signed up for a tool yet, or are looking for a new one, I definitely recommend you check them out. They’ve hooked up my newsletter subscribers with the promo code “dheld” which you can use for 25% off your service.

Portfolio Management

I know it’s a massive pain to connect all these exchange accounts, wallet addresses, CSV exports, etc, but there’s a silver lining to all this tax work you’ve had to do.

If you’re an active trader or participant in the ecosystem, it’s super tricky to track your performance/PnL (profit and loss). With TaxBit you now have that central dashboard where you can monitor everything going on in your crypto portfolio.

Conclusion

I’ll leave you with one last short and sweet note: If you HODL, you don’t have to mess with any of the above ;)

HODL,

Dan Held

If you’re a paid subscriber, check the top of this e-mail for the link to your voting form.

Note that I am not a tax expert, please consult with a tax expert before making financial decisions.

“The revenue laws are a code or system in regulation of tax assessment and collection. They relate to taxpayers, and not to non-taxpayers. The latter are without their scope. No procedure is prescribed for non-taxpayers, and no attempt is made to annul any of their rights and remedies in due course of law. With them Congress does not assume to deal, and they are neither of the subject nor of the object of the revenue laws....”

Long v. Rasmussen, Collector of Internal Revenue, et al. --District Court, D. Montana (281 F. 236 [1922])

Keyword here is "Taxpayer"

“The income tax is, therefore, not a tax on income as such. It is an excise tax with respect to certain activities and privileges which is measured by reference to the income which they produce. The income is not the subject of the tax: it is the basis for determining the amount of tax.”

(F. Morse Hubbard, Treasury Department legislative draftsman, House Congressional Record, March 27, 1943, page 2580)

1. The income tax is an excise.

2. Excise taxes are taxes on the gainful exercise of privileges.

3. You probably didn't earn your money by exercising any taxable privilege (or earned very little that way)