When will BTC DeFi TVL topple ETH?

[Guest post by Alexei Zamyatin, co-founder of BOB, the Hybrid L2. BOB is a portfolio company of Dan’s at Asymmetric]

Bitcoin is bigger than everything else combined. Although slightly below its peak, it maintains a $1.7T market cap and accounts for more than 60% of the value of all cryptocurrency assets.

This makes unlocking Bitcoin DeFi the opportunity of the decade. A mere 0.2% of Bitcoin’s total market cap is used in DeFi compared to 35% for Ethereum. That’s a 150x opportunity equivalent to $500B, greater than the combined market caps of the next three largest assets (ETH, USDT, XRP).

If you ask us, the question is when Bitcoin will flip Ethereum DeFi TVL, not if.

BOB

BOB is a unique Hybrid Layer-2 that fuses Bitcoin’s security and capital with Ethereum’s versatility and DeFi ecosystem - creating the safest and best place to earn yield on your Bitcoin.

BOB’s mission is to put Bitcoin at the heart of DeFi, bringing about this flippening within the next 12-24 months. As blockchain builders, it’s our job to address these risk factors with new technology and implementation approaches - and that’s exactly what BOB’s unique hybrid L2 model has been designed to do.

Living the dream

If it was possible to use Bitcoin in quality DeFi applications without needing to compromise on security, censorship resistance, or any of the things that make Bitcoin the largest and most secure digital asset, then we wouldn’t have any barriers to entry and BTC DeFi TVL would likely already far outstrip that of ETH and other chains.

However, as we all know, this can not be the case. Whatever an asset is, whether a Renaissance painting, gold and silver, or your Bitcoin, as soon as you move it out of secure storage, you must accept a certain level of risk in the pursuit of utility and importantly, yield.

If our ultimate dream situation isn’t quite possible, then what’s the next best thing? What about trustless deposits from the layer-1, bringing your BTC onto a smart contract chain without needing to trust any third party or multisig bridge. Then once it’s on the L2 and being used in DeFi, we’d want to be sure that all transactions are secured by and finalised on Bitcoin. And finally, if we want to bridge out to other ecosystems, those bridges should also be secured by Bitcoin. Ultimately, if we want people and institutions to feel more comfortable using their BTC in DeFi, every step of the process should be secured by Bitcoin itself.

This is exactly what BOB’s Hybrid L2 has been designed to deliver: mitigate these perceived risks and provide the ideal home for Bitcoin DeFi.

The Hybrid L2

The unique Hybrid model makes this possible by combining the best of Bitcoin and Ethereum: Bitcoin as the best known, most secure and censorship resistant asset, fused with the versatility, ease of use and innovative DeFi apps of Ethereum.

Bitcoin security - BOB is becoming a Bitcoin Secured Network (BSN) with Bitcoin finality provided by billions of dollars of Babylon staked Bitcoin. Every DeFi transaction on BOB, and every bridging action to other smart contract chains will be secured by Bitcoin.

Ethereum applications - As well as being a BSN, BOB is simultaneously an Ethereum rollup on the OP Superchain, providing fast cheap transactions and access to the full range of innovative DeFi applications such as Uniswap and Aave. BOB already has a TVL of $250M+ (6th largest rollup on L2beat) and an ecosystem of 100+ applications.

Trustless BTC deposits - Using a BitVM powered bridge design, users can deposit and withdraw BTC to and from BOB as long as Bitcoin is secure and there is at least one honest node in the network. This is much safer than existing BTC multisig bridges. This is bridging, reimagined for Bitcoin DeFi, powered by BitVM and ZK proofs.

Ease of use - It’s easier to access Bitcoin DeFi on BOB with best in class bridging between BOB, Bitcoin and Ethereum. And BOB Earn lets you deploy directly into Bitcoin LSTs, Uniswap, Euler and many more top tier DeFi apps with just a single click.

BitVM

BOB uses BitVM to power a trust-minimized Bitcoin bridge, allowing people to deposit and withdraw BTC from the Hybrid L2 without needing to trust a 3rd party. Before BitVM, this was not possible, and almost all existing Bitcoin bridges are trusted multisigs. Only now, for the first time in Bitcoin’s history, do we have a blueprint for achieving this in practice. This technical paper was co-authored by BOB co-founder Alexei Zamyatin.

BitVM allows you to execute programs on Bitcoin in an optimistic manner. The execution happens off-chain and disputes are then resolved and enforced on-chain. This gives BitVM bridges a far superior security model. The L2 verifies Bitcoin, Bitcoin verifies the L2. BTC deposits cannot be stolen as long as there is a single honest node in the network. This node can even be the depositor themself.

BOB’s BitVM bridge implementation has been designed specifically for Bitcoin Secured Networks in collaboration with Babylon and Fiamma. By taking advantage of the Bitcoin finality provided by Babylon Bitcoin staking, the BOB BitVM bridge inherits Bitcoin security without needing to address the complex issue of high Bitcoin Data Availability costs.

Bitcoin Secured Network (BSN) Growth Flywheel

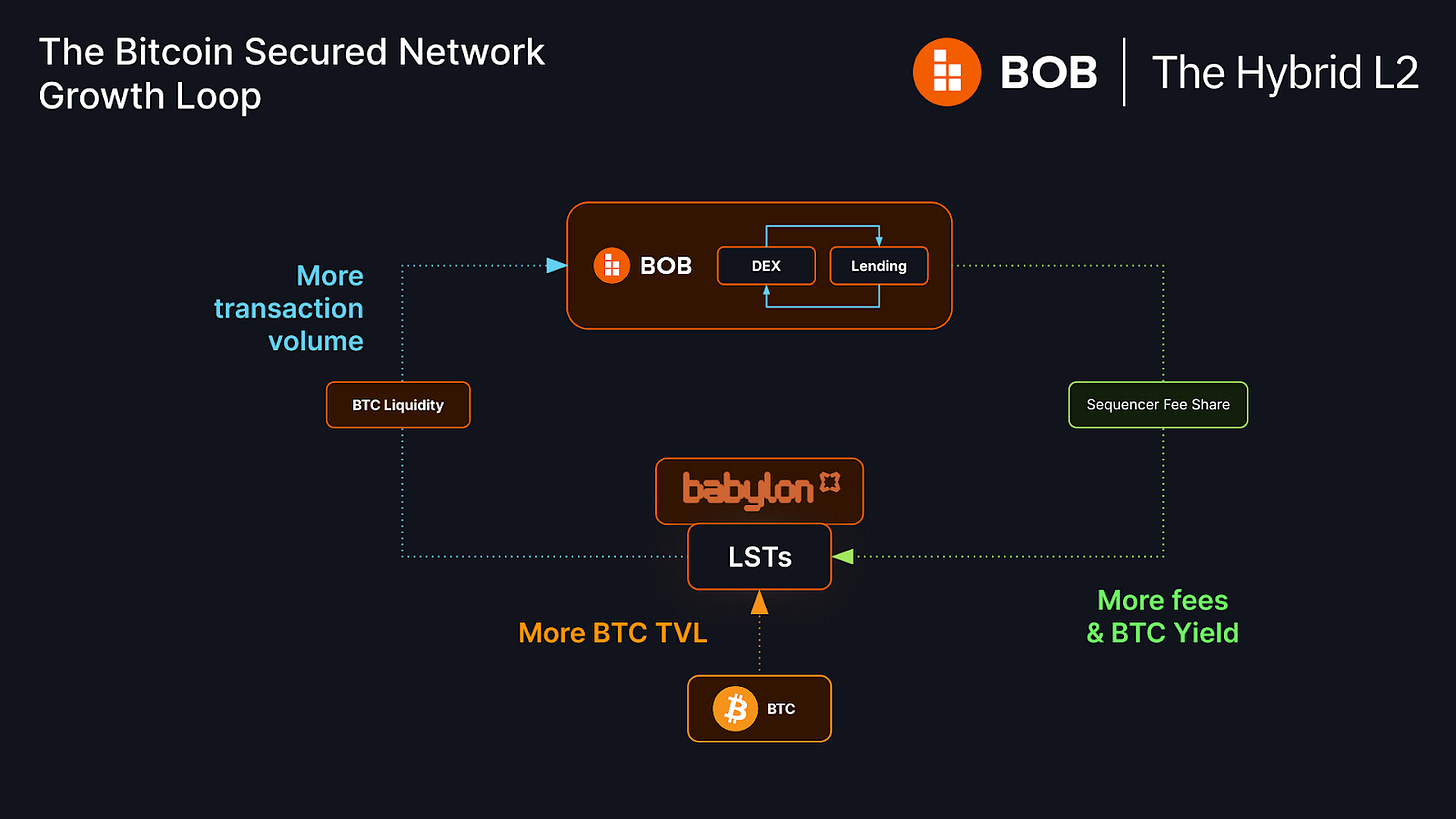

BSNs are the best place to use Bitcoin liquid staking tokens (LSTs). As well as receiving Bitcoin security from billions of dollars of Babylon staked Bitcoin, they are able to offer the best yield potential, thanks to a strong flywheel effect.

The more BTC LSTs people use in DeFi on BOB, the more fees are generated, which are shared with the Bitcoin stakers. This means more yield for LSTs, which then attracts even more stakers and LSTs to BOB, and so on and so on.

What is the risk/return for yield on your Bitcoin?

Different retail and institutional groups will have a different point at which the desire for yield outweighs perceived risk. It’s a classic adoption S-curve, where the early entrants take the biggest risks for the highest potential rewards, effectively acting as guinea pigs that prove out the technology and give the majority the confidence to jump onboard.

With the hybrid model providing Bitcoin security to Ethereum dapps, BOB’s mission is to put Bitcoin at the heart of decentralized finance, moving the industry along the s-curve towards an explosion in adoption and the TVL flippening. It won’t happen immediately as we need to build trust in the new technology. But when it happens it will feel like it happens all at once.

BOB 1-click DeFi is available in the Earn section of the BOB app. Take Bitcoin DeFi positions with a single transaction, for example earning yield for supplying Bitcoin LSTs to lending and borrowing platforms, or deposit into a Hybrid BTC vault to earn 4% BTC yield plus additional DeFi incentives from the BOB Rise DeFi campaign. That yield can then be multiplied several times by loop leveraging with Euler, only using Bitcoin assets to minimise the risk. This is a key part of the Hybrid L2 promise: Bitcoin DeFi with Ethereum-quality applications.

2025 is going to be the year for Bitcoin DeFi.

ETH will never flippen Bitcoin, but Bitcoin DeFi may flippen ETH DeFi.

Learn more about BOB: Website | Twitter | Discord | Telegram

Thanks for sharing this but do you need more insight

Just to be clear, BOB is a Stacks competitor?