Bitcoin Privacy

“Arguing that you don’t care about privacy because you have nothing to hide is like arguing that you don’t care about free speech because you have nothing to say… If we don’t have privacy, what we’re losing is the ability to make mistakes, we’re losing the ability to be ourselves. Privacy is the fountainhead of all other rights.” - Edward Snowden

Privacy is a fundamental human right.

When it comes to financial privacy, your personal finances should not be up to public scrutiny. This ensures that money is allocated efficiently in the economy and groups are not marginalized due to anything political (ex: conservatives, ethnic groups, etc).

With money, there is a term called “fungibility” which means that one asset is equally exchangeable with another of the same asset.

Concerns have been raised regarding how the lack of privacy in Bitcoin may impact fungibility which hurts Bitcoin’s long term prospects. Since Bitcoin’s ledger is visible to all, there are worries that states could deanonymize users, blacklist coins, etc. If certain Bitcoin were “tainted” then it could break the interchangeability of it.

However, this is a classic “Bitcoin needs fixing” argument:

> Identify “problem” and claim its imperative for Bitcoin’s success with little data to show (ex: big block argument that Bitcoin was meant to be a cheap PayPal)

> What looks to be a simple solution (Moar block space, Moar privacy), but has nuanced tradeoffs

I don’t think we have much cause for concern regarding Bitcoin’s privacy, which I dig into below.

What is considered fungible?

The standard for financial privacy is fiat cash. What I’m talking about is dollars, Euro, yen, in your pocket, available to transact at nearly any merchant without question.

However, people often forget that when you deposit large values or purchase large items, it’s not at all fungible. They require identifiable information + questions around acquisition of said money, and may check those bills against serial numbers that have been recorded in crimes. Additionally, there are often cameras in businesses that could record you, digital services that are tied to your name, etc.

So even the most fungible money, fiat cash, has limitations in terms of its fungibility.

Bitcoin is perfectly fungible at the network level, 1 Bitcoin = 1 Bitcoin, and they can be sent to any account. It’s only when Bitcoin interacts with KYC/AMLed services where it may be flagged or questioned, just like your fiat cash.

Finally, there is no secondary market for “tainted Bitcoins” which means Bitcoin is still fungible even on the KYC/AMLed level.

Fungibility and privacy

There is no such thing as perfect privacy.

You’re leaking data everywhere:

The weather app on your phone is selling your location data

Social media apps are selling your interests

VPN apps are selling your usage

Do you have an online presence or use a smartphone? Well you’re basically shit out of luck on the privacy front.

In regards to Bitcoin, even if you do a CoinJoin (decentralized coin mixer) you need to be running a full node behind Tor, have never talked about Bitcoin in person or online, purchased your Bitcoin p2p with no KYC/AML, do perfect coin control, hopefully don’t leave a fingerprint with your wallet UTXO selection, have never checked the price of Bitcoin on mobile or web via logged in, etc.

0.001% do it perfectly.

Perfect privacy is not needed to preserve fungibility since perfect privacy is an impossible standard.

Below is an image from the Bitcoin wiki page on maintaining privacy with Bitcoin, this is 1/3rd of the list.

Auditability vs Privacy

There is a nuanced argument around the tradeoff between fungibility and auditability.

Auditability is important because Bitcoin’s breakthrough is the monetary policy that enables the 21M hard cap (scarcity). We need to be able to audit the money supply at any time to ensure that there hasn’t been a mistake made.

If we lose confidence in the auditability of the 21M hard cap, then Bitcoin is effectively worthless.

Full privacy means auditability of the 21M hard cap is compromised which undermines the entire premise/value of Bitcoin.

Zcash and Monero, both privacy coins that have full privacy on Layer 1 have had exploits where “inflation bugs” were undetected for some time. Even more troubling is that post detection, there isn’t a good way to remove the “artificial” coins from the network.

Privacy coins aren’t being used for privacy

Privacy coins were created because it was assumed the market had demand for fully private coins on Layer 1.

However, in practice, they’ve seen low penetration in dark market transactions where they would be most useful:

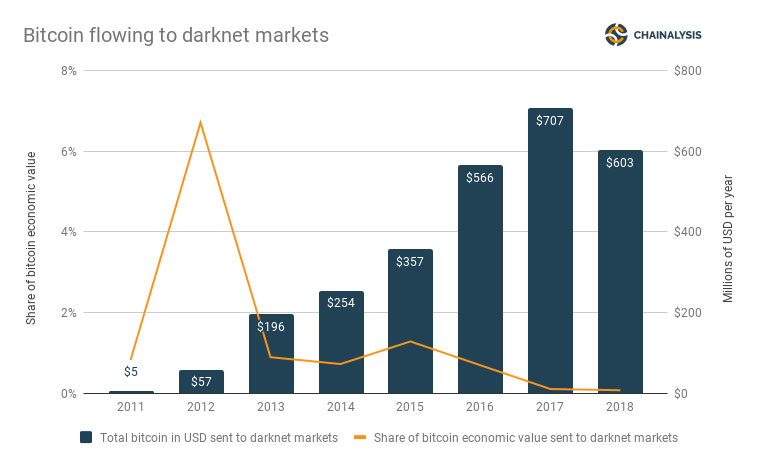

“Bitcoin remains the most popular crypto on the darknet, with anonymous coins representing only a very small proportion of all transactions — and with the most popular privacy coin Monero sitting at "5 percent or less” - Chainalysis (blockchain intelligence company)

So why do folks still use Bitcoin even though it isn’t as private as Monero or Zcash? Network effects and pretty good privacy. Bitcoin is the schelling point for transacting illegal items, and Bitcoin offers pretty good privacy with CoinJoins (decentralized mixing service).

Furthermore, the transactions you’d ideally need to have the best privacy for only represent a very small % of network usage:

“Across all the scams, hacks, and darknet market transactions surveyed by Chainalysis, the total number comprised less than 1 percent of all economic bitcoin activity in 2018, down from 7% in 2012.”

If we compromised auditability for a use case that is strongest for only 1% of transactions, then we’ve completely missed the mark.

Bitcoin is private enough

Privacy isn’t the blocker for mass adoption of Bitcoin. Otherwise we’d see skyrocketing usage of privacy coins vs coins with limited privacy.

Folks who say that Bitcoin needs privacy have no data that shows that it is preferred by market participants.

CoinJoin + Lightning (L2) + Schnorr (upgrade) dramatically improve privacy without sacrificing auditability.

Ultimately, Bitcoin survives a 6102 (US executive order to seize gold) not through privacy, but through market penetration. If 50%+ of the pop owns Bitcoin it becomes extremely hard to ban, as politicians who support a ban would be voted out (and many would likely own Bitcoin). 1% of the population poorly implementing privacy isn’t a deterrent.

HODL,

Dan Held

Links

Zcash inflation bug

Bitcoin Darknet transactions

Remaining private on Bitcoin