Bitcoin Lending: The Trojan Horse

(Guest post by Matt Luongo from Thesis)

[Disclosure: Dan is an investor and advisor in Mezo]

I recently detailed my seven-year journey to secure a mortgage with my Bitcoin. That journey solved a precise challenge: deploy the hardest collateral on earth to secure a roof for my family, without surrendering the private keys that guarantee sovereignty.

In doing so, I left behind a legacy system that mistranslates Bitcoin and proved that self-custodied sats can fund real-world goals. Homeownership became another milestone on the path to freedom, secured by my keys under my control.

The Bank's Bitcoin Capture Strategy Through Mortgage Mechanisms

On June 26, 2025, FHFA director William Pulte issued a formal directive to Fannie Mae and Freddie Mac (the largest mortgage financiers in the U.S.) to propose ways to treat cryptocurrency as a valid asset for mortgage reserves.

On the surface, this seems good, but buried within was a poison pill, a clause so restrictive that it inverts the very purpose of Bitcoin: only assets “evidenced and stored on a U.S.-regulated centralized exchange” would be considered.

This single sentence is the linchpin of the entire strategy.

Your cold storage hardware wallet is disqualified. Your multi-signature vault does not count. The only bitcoin that is "good enough" for the legacy financial system is bitcoin that you have first surrendered to a third-party custodian like Coinbase or Fidelity Digital Assets.

The Threat of Rehypothecation

The insistence on custody is rooted in enabling rehypothecation – when banks and brokers use assets posted as collateral by their clients for their own purposes. This typically involves creating more credit from that single asset.

Once you deposit Bitcoin with a custodian, you don’t own your BTC onchain anymore – you hold an IOU. The BTC then becomes an entry in the exchange's private database, and this database entry—this promise—can be endlessly recycled: lent to a hedge fund, re-pledged for another loan, stacked into a chain of claims tied to the same coin.

This is the modern digital equivalent of fractional-reserve banking.

The history of cryptocurrency is littered with centralized custodians that blew up thanks to, at least in part, rehypothecation. Mt. Gox, QuadrigaCX, Celsius, FTX, and BlockFi are all stark reminders of what happens when we give up control.

Regulation, Re-Centralization, and the Cantillon Effect

This strategy of using the language of safety and regulation as a weapon for control is not new. Framed as consumer protection, these rules favor institutions that meet strict compliance standards – typically large, centralized custodians.

This effectively channels the flow of capital, defining "legitimate" Bitcoin as "custodial" Bitcoin, thereby capturing the asset and forcing it back into a framework that the legacy institutions can monitor, control, and ultimately, manipulate.

This regulatory capture creates a powerful, self-reinforcing loop. As the FHFA mandate forces more bitcoin into custodial accounts for mortgage eligibility, the assets under custody and trading volumes of these regulated exchanges swell. This increased scale makes them appear more liquid, more standard, and "safer", further cementing their legitimacy while making non-custodial, sovereign paths seem niche, complex, or even reckless by comparison.

Let’s be clear. The same institutions that:

Froze accounts in 2008

Funded the inflationary crises that devalue our paychecks

Called Bitcoin a scam for over a decade

…now want to hold your crypto for you.

The legacy system is laying a trap: dangle access to credit, then force you to give up control. But Bitcoin was never meant to be absorbed into that machine.

If the threat is rehypothecation, the answer is self-custody. If the problem is centralized control, the answer is sovereign infrastructure.

That’s where Mezo comes in.

Mezo: The Bitcoin platform that gives you sovereignty

What is Mezo?

Mezo is built to let you bank on yourself—no intermediaries, no compromise. This platform brings to life Hal Finney’s 2010 vision of a world where Bitcoin is the ultimate settlement layer, with financial instruments built on top of it.

Where traditional finance demands custody, control, and compliance, Mezo offers a clean alternative:

TradFi: Hand over your Bitcoin → Trust a custodian → Hope they don’t lose it → Maybe get a loan

Mezo: Hold your own Bitcoin → Prove it onchain → Borrow with confidence → Stay in control

With Mezo live, you can deposit your self-custodied BTC and borrow against it. You’ll mint MUSD, our 100% Bitcoin-backed stablecoin, at 1-5% fixed APR. This is where Mezo is fundamentally different from other lending platforms. Most platforms rely on a limited pool of pre-deposited dollars that you borrow from. Mezo doesn't have a pool. Instead, the protocol acts like a digital mint: when you supply Bitcoin as collateral, it generates brand-new, fully-backed MUSD.

This "supply-side" liquidity model is what makes our Bitcoin loan terms possible:

Low, Fixed Interest Rates: To reward early adopters, Mezo is launching with a special 1% introductory fixed rate.

High Capital Efficiency: Access loans up to 90% of your Bitcoin's value (LTV), far exceeding the industry standard.

You can fund your down payment or save for retirement all while your pristine collateral remains yours.

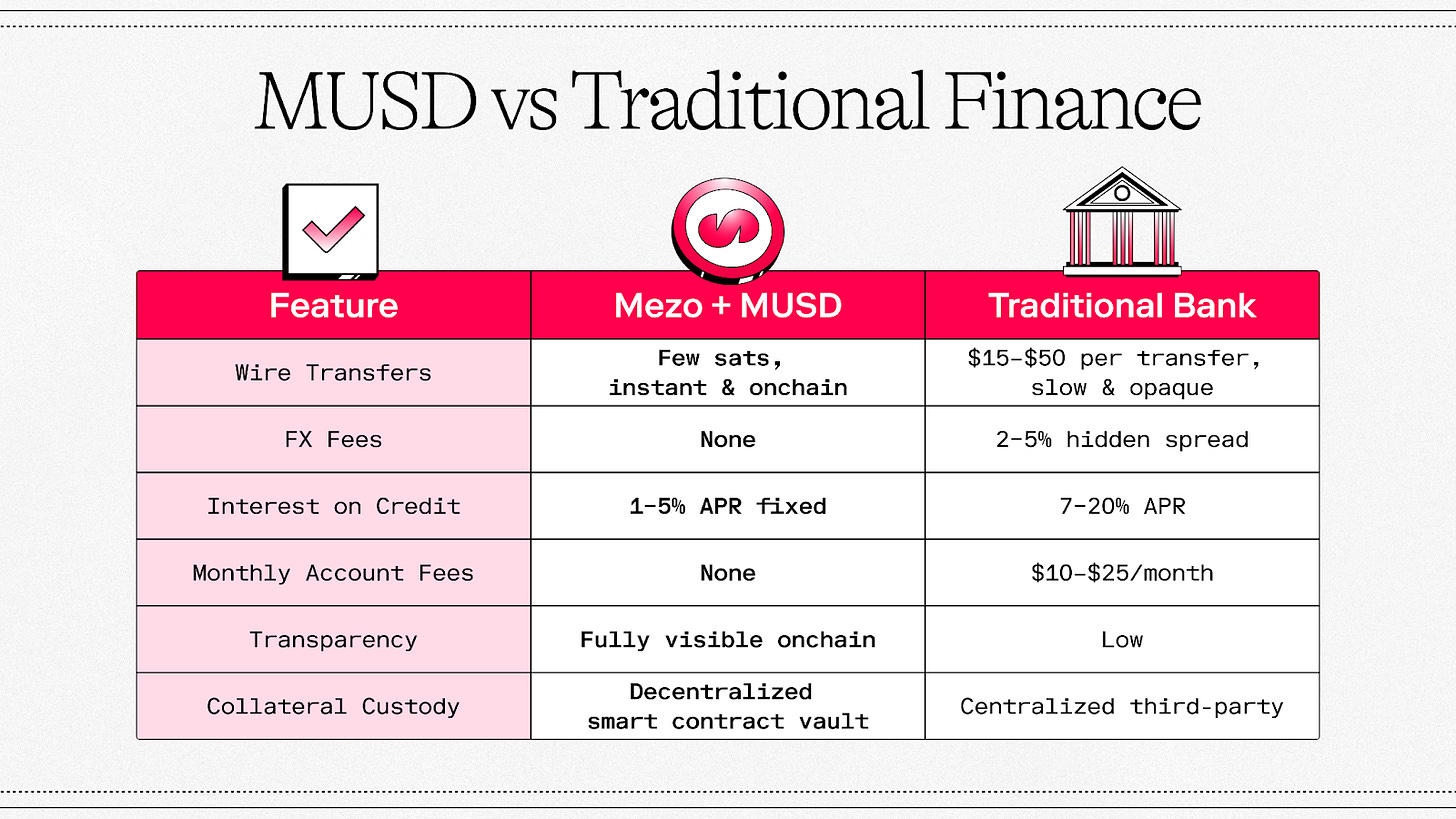

When it comes to Mezo vs. the banks, the choice is clear:

The Final Boss Revealed

They're betting you'll forget. Forget 2008. Forget the bailouts. Forget the money printer. Forget why Satoshi built the escape hatch in the first place.

They're betting that when you see that perfect house, when the mortgage application sits before you, when they promise to make it easy—you'll quietly slide your Bitcoin into their vaults. After all, it's just for the down payment. Just for compliance. Just this once.

The banks revealed themselves. They're not adopting Bitcoin—they're trying to adopt you back into their cage. They're the final boss.

Your keys. Your coins. Your move.

Mezo is live. Borrow against your BTC today.

Mezo is for anyone who believes money should serve people. Your Bitcoin can finally work without selling it. Borrow MUSD at a 1-5% fixed rate and keep your Bitcoin exposure. Available now at mezo.org.

I ve borrowed MUSD, swapped to MUSDC, but I don t see any option to send to external wallet!, any help available, I tried on x...

I don’t understand. When I borrow against my BTC, I get dollars transferred into my traditional bank then I use the USD to buy whatever, say a car. That couldn’t happen with Mezo, right?